Dollar posted its biggest weekly drop since June this week. And here are my trading results:

Monday: +71

Tuesday: +11

Wednesday: +148

Thursday: +29

Friday: 0 (still holding 3 positions, currently up 25 pips).

A new swing pot has been setup in addition to my daytrading account. Hopefully, I can find some good opportunities next week.

Saturday, September 23, 2006

Thursday, September 21, 2006

Scanning Daily Swing Opportunities

For the past 2 months, I have been executing many trading opportunities through H1 charts. Basically, I found that my daytrading results aren't too bad at all, but the risk-reward ratio of 1:1 (sometimes even less) looks uninspiring.

Since I am concentrating on the shorter time frame charts, I often miss the bigger picture of market movements. For example, yesterday's closing price of GBP/USD is actually a new valid entry (1.8873) for swing setup based on the D1 chart. After yesterday's wild price swing due to the FED decision, I was already (mentally) exhausted by the intraday movement and already out of my position.

I like the daytrading style very much since it provides me with quick pips (if I could stick to my discipline and follow strict rules). Hence. I am not going to abandon my trading style yet. In fact, my plan is to add a swing trading account and have myself familiar with this approach.

Let's make lots of pip (money).

Since I am concentrating on the shorter time frame charts, I often miss the bigger picture of market movements. For example, yesterday's closing price of GBP/USD is actually a new valid entry (1.8873) for swing setup based on the D1 chart. After yesterday's wild price swing due to the FED decision, I was already (mentally) exhausted by the intraday movement and already out of my position.

I like the daytrading style very much since it provides me with quick pips (if I could stick to my discipline and follow strict rules). Hence. I am not going to abandon my trading style yet. In fact, my plan is to add a swing trading account and have myself familiar with this approach.

Let's make lots of pip (money).

Wednesday, September 20, 2006

Crazy Days, Crazy Trades, Crazy Pips

Yesterday was a coup day. Today, it's a Fed day.

Basically, yesterday's bizarre event caught everyone off guard. As a result, people rushed into buying the dollar and pushing the dollar higher during the late US session, even though its fundamental outlook was pretty uninspiring. I was on the opposite side of the trade, picking quite a few dollar short positions in usd/yen, usd/chf as well as cable. Up to this moment, I managed to turn some of these overnight losing positions into profitable ones.

A long list of short USD/yen trades:

(Tuesday's closing positions)

First entry at 117.76 (from Monday) exit 117.16 +60 pips

Entered again at 117.09 stopped out 117.20 -11 pips

Entered again at 117.14 stopped out at 117.26 -12 pips

Entered again at 117.20 stopped out 117.46 -26 pips

(Today's)

Entered at 117.77 exit at 117.28 for +49 pips

Entered at 117.57 exit at 117.23 +34 pips

Entered at 117.37 exit at 117.14 + 23 pips

The rest of today's list:

Entered long cable at 1.8804 exit 1.8825 +21 pips

Entered long cable at 1.8850 exit 1.8875 +25 pips

Entered short swissy at 1.2521 exit 1.2501 +20 pips

Right now, I am still hanging onto a long cable position, a short swissy position (both with tight stops) as well as my underperforming, losing loonie positions. I'm waiting for the FED...

Basically, yesterday's bizarre event caught everyone off guard. As a result, people rushed into buying the dollar and pushing the dollar higher during the late US session, even though its fundamental outlook was pretty uninspiring. I was on the opposite side of the trade, picking quite a few dollar short positions in usd/yen, usd/chf as well as cable. Up to this moment, I managed to turn some of these overnight losing positions into profitable ones.

A long list of short USD/yen trades:

(Tuesday's closing positions)

First entry at 117.76 (from Monday) exit 117.16 +60 pips

Entered again at 117.09 stopped out 117.20 -11 pips

Entered again at 117.14 stopped out at 117.26 -12 pips

Entered again at 117.20 stopped out 117.46 -26 pips

(Today's)

Entered at 117.77 exit at 117.28 for +49 pips

Entered at 117.57 exit at 117.23 +34 pips

Entered at 117.37 exit at 117.14 + 23 pips

The rest of today's list:

Entered long cable at 1.8804 exit 1.8825 +21 pips

Entered long cable at 1.8850 exit 1.8875 +25 pips

Entered short swissy at 1.2521 exit 1.2501 +20 pips

Right now, I am still hanging onto a long cable position, a short swissy position (both with tight stops) as well as my underperforming, losing loonie positions. I'm waiting for the FED...

Monday, September 18, 2006

Real Trades, Real Thrills, Real Pains

It has been an eventful day. Here is the trade breakdown in the order as they happened:

Exit short USD/JPY at 117.23 for +71 pips

Exit short USD/JPY at 117.32 for +36 pips

Exit long GBP/USD at 1.8825 for +40 pips

Exit short USD/CHF at 1.2533 for +23 pips

I thought I had a great day, but unfortunately...

Stopped out of long GBP/USD at 1.8756 for -82 pips (what was I thinking earlier, long just before the reversal, altered stop, ignoring the market force, hence a bad undisciplined trade which spoiled the day efforts)

Also Stopped out of short USD/CHF at 1.2551 for -17 pips

Exit short USD/JPY at 118.05 for +5 pips

Right now, still working on 2 positions:

Short USD/JPY at 117.76

Short USD/CAD at 1.1181

The moral story of the day is do not force trades - you do not need to be in the position every single time and have it to go your way every time. Be humble to the market. They are many traders out there willing to take the opposite direction. Always measure the risk and reward for each trade. Most importantly, learn how to exit to minimise risk, an important skill which I seriously lack of.

Exit short USD/JPY at 117.23 for +71 pips

Exit short USD/JPY at 117.32 for +36 pips

Exit long GBP/USD at 1.8825 for +40 pips

Exit short USD/CHF at 1.2533 for +23 pips

I thought I had a great day, but unfortunately...

Stopped out of long GBP/USD at 1.8756 for -82 pips (what was I thinking earlier, long just before the reversal, altered stop, ignoring the market force, hence a bad undisciplined trade which spoiled the day efforts)

Also Stopped out of short USD/CHF at 1.2551 for -17 pips

Exit short USD/JPY at 118.05 for +5 pips

Right now, still working on 2 positions:

Short USD/JPY at 117.76

Short USD/CAD at 1.1181

The moral story of the day is do not force trades - you do not need to be in the position every single time and have it to go your way every time. Be humble to the market. They are many traders out there willing to take the opposite direction. Always measure the risk and reward for each trade. Most importantly, learn how to exit to minimise risk, an important skill which I seriously lack of.

Saturday, September 16, 2006

2nd Week of September -94 pips

Exit one late Friday trade of long GBP/USD at 1.8806 for +34 pips. This gives me a total loss of -94 pips for this week. The dismay performance was on account of my undisciplined swissy trades. I am still fully loaded with positions (mainly dollar-bearish) before the start of G7 meeting. Hope I can redeem myself next week.

Thursday, September 14, 2006

CHF Trades -196

I am heading towards a first negative week since the start of August. I might have overtraded this week, but most importantly I didn't take my losses accordingly. Moreover, I kept adding to a loser position. The loser trade was shorting the $/CHF 4 times. The results were as bad as it could be: +20, followed by -122 (I usually use a mental stop of 60 pips), -62 (a revenge trade that went horribly wrong), and -32. This put me at a total of -196 on the swissy trade. If I did everything right and kept my discipline, it should be just a loss of -74 pips - a magnitude which is acceptable based on my trading style. I must remind myself not to be afraid running into a brick wall once in a while. I know that I have the ability to earn it right back in the next round of trades.

I made some progress with yesterday's positions. 3 out of 4 are good ones.

Closed long GBP/USD at 1.8808 for +49 pips

I took my profit very early (due to my daytrading style) and didn't manage to reenter another position. I should be trying the multi-lot exit strategy which could be fairly effective in capturing larger moves (as proven today by trader rich - good job, rich!). I still need some time to think it thru on how it could best fit into my trading style.

Closed short USD/CAD at 1.1134 for +48 pips

Greed nearly took over me. I lowered the take profit level to 1.1095 and prepared to ride it through. Luckily I was out before it made a u-turn at 1.1120 ( 1.1120 was a target I set out yesterday).

Exit short USD/CHF at 1.2516 for -32 pips

Nothing much to say about this trade. Fear did play a part in this hectic week.

Short USD/JPY at 117.68 - still working

This trade is doing ok right now, managed to survive earlier as it came within a striking distance (maybe 1-2 pips) to the tight stop level that I use. Probably, will move the level to breakeven and hopefully let it run towards my target.

P/L for this week so far: -128

I made some progress with yesterday's positions. 3 out of 4 are good ones.

Closed long GBP/USD at 1.8808 for +49 pips

I took my profit very early (due to my daytrading style) and didn't manage to reenter another position. I should be trying the multi-lot exit strategy which could be fairly effective in capturing larger moves (as proven today by trader rich - good job, rich!). I still need some time to think it thru on how it could best fit into my trading style.

Closed short USD/CAD at 1.1134 for +48 pips

Greed nearly took over me. I lowered the take profit level to 1.1095 and prepared to ride it through. Luckily I was out before it made a u-turn at 1.1120 ( 1.1120 was a target I set out yesterday).

Exit short USD/CHF at 1.2516 for -32 pips

Nothing much to say about this trade. Fear did play a part in this hectic week.

Short USD/JPY at 117.68 - still working

This trade is doing ok right now, managed to survive earlier as it came within a striking distance (maybe 1-2 pips) to the tight stop level that I use. Probably, will move the level to breakeven and hopefully let it run towards my target.

P/L for this week so far: -128

Wednesday, September 13, 2006

A Tough Week So Far

I still have the following positions to work with:

Long GBP/USD at 1.8759, target - 1.8815 , stop - 1.8719

Short USD/JPY at 117.68, target - 116.95, stop 117.78 (Tight stop)

Short USD/CHF at 1.2486, target - 1.2430, stop 1.2516

Short USD/CAD 1.1182, target - 1.1120, stop 1.1215

Long GBP/USD at 1.8759, target - 1.8815 , stop - 1.8719

Short USD/JPY at 117.68, target - 116.95, stop 117.78 (Tight stop)

Short USD/CHF at 1.2486, target - 1.2430, stop 1.2516

Short USD/CAD 1.1182, target - 1.1120, stop 1.1215

Sunday, September 10, 2006

1st Week of September +269 pips

Friday, 8 September

Total trades: 10 (8 winners, 2 losers)

Results: +164 pips

Long USD/CHF 1.2423 Exit 1.2428 (+5) Still early in the day, not sure what's gonna happen next...

Long USD/CHF 1.2428 Exit 1.2432 (+4) Conservative trade

Long USD/CAD 1.1121 Exit 1.1115 (-6) Considered myself lucky? Big drawdown earlier

Long USD/CHF 1.2444 Exit 1.2432 (-12) A hesitated move

Long USD/CAD 1.1130 Exit 1.1178 (+48) Yes! Dare to long again

Long USD/CHF 1.2448 Exit 1.2476 (+28)

Long USD/JPY 116.41 Exit 116.66 (+25)

Long USD/JPY 116.49 Exit 116.65 (+16) Confidence boosted, add another long position

Long USD/CHF 1.2444 Exit 1.2480 (+36)

Long USD/JPY 116.75 Exit 116.95 (+20) Last trade of the week, add third long JPY position due to strong support + price action

Thursday, 7 September

Total trades: 6 (4 winners, 1 loser, 1 breakeven)

Results: +10 pips

Short GBP/USD 1.8839 Exit 1.8830 (+9)

Long USD/CHF 1.2363 Exit 1.2363 (0) Fear of losing, gave up too early

Long USD/JPY 116.66 Exit 116.05 (-61) Unexpected reversed move, caught me unprepared, profit not guarded, big ouch!

Long USD/JPY 116.15 Exit 116.29 (+14) Revenge trade

Long USD/JPY 116.22 Exit 116.35 (+13) Revenge trade

Long USD/CAD 1.1059 Exit 1.1094 (+35)

Wednesday, 6 September

Total trades: 2 (2 winners)

Results: +35 pips

Long USD/JPY 116.14 Exit 116.38(+24)

Long USD/JPY 116.62 Exit 116.73 (+11)

Tuesday, 5 September

Total trades: 4 (3 winners, 1 breakeven)

Results: +60 pips

Long USD/CHF 1.2297 Exit 1.2315 (+18)

Short GBP/USD 1.9053 Exit 1.9019 (+34) Definitely too early exit

Long USD/CAD 1.1109 Exit 1.1109 (0) All previous losses recovered, already a happy man

Long USD/CHF 1.2325 Exit 1.2333 (+8)

Monday, 4 September

No trade

Total trades: 10 (8 winners, 2 losers)

Results: +164 pips

Long USD/CHF 1.2423 Exit 1.2428 (+5) Still early in the day, not sure what's gonna happen next...

Long USD/CHF 1.2428 Exit 1.2432 (+4) Conservative trade

Long USD/CAD 1.1121 Exit 1.1115 (-6) Considered myself lucky? Big drawdown earlier

Long USD/CHF 1.2444 Exit 1.2432 (-12) A hesitated move

Long USD/CAD 1.1130 Exit 1.1178 (+48) Yes! Dare to long again

Long USD/CHF 1.2448 Exit 1.2476 (+28)

Long USD/JPY 116.41 Exit 116.66 (+25)

Long USD/JPY 116.49 Exit 116.65 (+16) Confidence boosted, add another long position

Long USD/CHF 1.2444 Exit 1.2480 (+36)

Long USD/JPY 116.75 Exit 116.95 (+20) Last trade of the week, add third long JPY position due to strong support + price action

Thursday, 7 September

Total trades: 6 (4 winners, 1 loser, 1 breakeven)

Results: +10 pips

Short GBP/USD 1.8839 Exit 1.8830 (+9)

Long USD/CHF 1.2363 Exit 1.2363 (0) Fear of losing, gave up too early

Long USD/JPY 116.66 Exit 116.05 (-61) Unexpected reversed move, caught me unprepared, profit not guarded, big ouch!

Long USD/JPY 116.15 Exit 116.29 (+14) Revenge trade

Long USD/JPY 116.22 Exit 116.35 (+13) Revenge trade

Long USD/CAD 1.1059 Exit 1.1094 (+35)

Wednesday, 6 September

Total trades: 2 (2 winners)

Results: +35 pips

Long USD/JPY 116.14 Exit 116.38(+24)

Long USD/JPY 116.62 Exit 116.73 (+11)

Tuesday, 5 September

Total trades: 4 (3 winners, 1 breakeven)

Results: +60 pips

Long USD/CHF 1.2297 Exit 1.2315 (+18)

Short GBP/USD 1.9053 Exit 1.9019 (+34) Definitely too early exit

Long USD/CAD 1.1109 Exit 1.1109 (0) All previous losses recovered, already a happy man

Long USD/CHF 1.2325 Exit 1.2333 (+8)

Monday, 4 September

No trade

Friday, September 8, 2006

Some New Lessons

A new lesson learnt - Always Expect The Unexpected. As the German deputy finance minister Mirow commented yesterday that the weak Japanese Yen will be discussed at the upcoming G7 meeting, Yen instantly rallied and my profitable long USD/JPY position tanked immediately into a loss of 61 pips. This event caught me off-guard completely. Since then, I was into a revenge trading mode - scalping for profits here and there, trying to limit the damage done.

Long USD/JPY 116.15 Exit 116.29 (+14 pips)

Long USD/JPY 116.22 Exit 116.35 (+13 pips)

Still have a running long opened at 116.49

There was another lesson too - Don't Give Up Too Quickly. Market always make you think the wrong way. Yesterday, I dumped both my short cable and long USD/CHF position for nothing. I didn't profit from those positions (only a mere 9 pips). If I managed to stay calm and confidence enough, I should be making a substantial gain for this week. But this is not meant to be. Today is a new day and I am still bullish on USD/CHF:

Long USD/CHF 1.2423 Exit 1.2428 (+5 pips)

Long USD/CHF 1.2428 Exit 1.2432 (+4 pips)

Still have 2 long positions at 1.2444

Besides all that, sometimes we need to Take Necessary Risks. On top of a losing position, I added a long USD/CAD trade at 1.1059 yesterday which was later closed at 1.1094 for for +35 pips. So I still have a long USD/CAD opened at 1.1121.

Let see how market pans out today....

Long USD/JPY 116.15 Exit 116.29 (+14 pips)

Long USD/JPY 116.22 Exit 116.35 (+13 pips)

Still have a running long opened at 116.49

There was another lesson too - Don't Give Up Too Quickly. Market always make you think the wrong way. Yesterday, I dumped both my short cable and long USD/CHF position for nothing. I didn't profit from those positions (only a mere 9 pips). If I managed to stay calm and confidence enough, I should be making a substantial gain for this week. But this is not meant to be. Today is a new day and I am still bullish on USD/CHF:

Long USD/CHF 1.2423 Exit 1.2428 (+5 pips)

Long USD/CHF 1.2428 Exit 1.2432 (+4 pips)

Still have 2 long positions at 1.2444

Besides all that, sometimes we need to Take Necessary Risks. On top of a losing position, I added a long USD/CAD trade at 1.1059 yesterday which was later closed at 1.1094 for for +35 pips. So I still have a long USD/CAD opened at 1.1121.

Let see how market pans out today....

Tuesday, September 5, 2006

Feeling Good This Morning

It was a slow day yesterday due to US Labor Day. Closing a few trades this morning:

2.00am Exit long USD/CHF at 1.2315 for +18 pips.

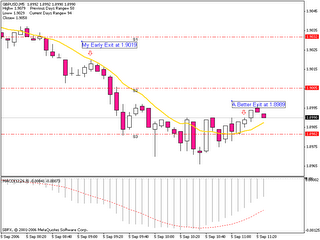

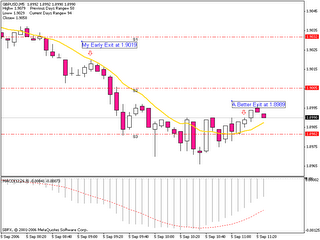

8.15am Exit short GBP/USD at 1.9019 for +34 pips. Somehow, just missed the second leg of rally which should have netted extra 30 pips. See chart below.

10.05am Yes ! Finally, dumped long USD/CAD at 1.1109 for breakeven. Could be running out of steam already as it recovered from a low of 1.1032. I didn't add a new position at 1.1072 level as suggested yesterday.

10.05am Yes ! Finally, dumped long USD/CAD at 1.1109 for breakeven. Could be running out of steam already as it recovered from a low of 1.1032. I didn't add a new position at 1.1072 level as suggested yesterday.

2.00am Exit long USD/CHF at 1.2315 for +18 pips.

8.15am Exit short GBP/USD at 1.9019 for +34 pips. Somehow, just missed the second leg of rally which should have netted extra 30 pips. See chart below.

10.05am Yes ! Finally, dumped long USD/CAD at 1.1109 for breakeven. Could be running out of steam already as it recovered from a low of 1.1032. I didn't add a new position at 1.1072 level as suggested yesterday.

10.05am Yes ! Finally, dumped long USD/CAD at 1.1109 for breakeven. Could be running out of steam already as it recovered from a low of 1.1032. I didn't add a new position at 1.1072 level as suggested yesterday.

Saturday, September 2, 2006

Trading Review For Month Of August

On Friday afternoon, I managed to exit my struggling short GBP/USD trade (with ~100 pips drawdown at one point) for +2 pips, taking advantage of the release of US job report. I decided not to add another short trade although there was a clear chance to re-enter short that morning. I was lucky cos' market did a U-turn soon after my exit. Late afternoon, I tried to scalp from the low of USD/CHF but didn't yield any positive result (-4 pips). Market was pretty done after that. This brings the week's total to +51 pips and a opened losing USD/CAD to be carried over to the next week.

So an overall summary for the month of August:

Total pips (5 trading weeks): 177 + 174 + 206 + 14 + 51 = 622

Worst 5 trades: 1/8 GBP/USD (-52); 22/8 GBP/JPY (-74); 24/8 GBP/USD (-61); 29/8 USD/CHF (-72) and 1/9 GBP/USD (+2 due to worst drawdown)

Worst drawdown: -105

Top 5 trades: 15/8 USD/JPY (+57) - Couldn't find one outstanding trade, but there are few others with over 50 pips.

Looking at these stats, there were just too many bad GBP trades. Perhaps, I need to throw in the towel and admit that I am no match for Mr. Sterling Pound.

So an overall summary for the month of August:

Total pips (5 trading weeks): 177 + 174 + 206 + 14 + 51 = 622

Worst 5 trades: 1/8 GBP/USD (-52); 22/8 GBP/JPY (-74); 24/8 GBP/USD (-61); 29/8 USD/CHF (-72) and 1/9 GBP/USD (+2 due to worst drawdown)

Worst drawdown: -105

Top 5 trades: 15/8 USD/JPY (+57) - Couldn't find one outstanding trade, but there are few others with over 50 pips.

Looking at these stats, there were just too many bad GBP trades. Perhaps, I need to throw in the towel and admit that I am no match for Mr. Sterling Pound.

Subscribe to:

Comments (Atom)