EUR/USD (1.2148)

Trend: Up

Current position: Neutral

Euro strikes 2-week high of 1.2161 amid mounting ECB rate hike talk. Look to sell if support fails to hold at 1.2130.

GBP/USD (1.7840)

Trend: Down

Current position: Short

Sterling hit one-month high of 1.7898 against the dollar. Stay short from 1.7835 with 25-pips stop loss.

USD/CHF (1.2728)

Trend: Down

Current position: Neutral

Will consider to long when there is an upward momentum breaking through resistance level of 1.2750.

USD/JPY (115.24)

Trend: Down

Current position: Neutral

Dollar retreats from 2-year high vs. yen. Stay neutral for now.

Thursday, October 27, 2005

Wednesday, October 26, 2005

Short-term Outlook

EUR/USD (1.2078)

Trend: Up

Current position: Neutral

Euro eases from two-week highs of 1.2139 against dollar. Look to sell if support fails to hold at 1.2044.

GBP/USD (1.7743)

Trend: Up

Current position: Short

Sterling retreated from a one-month high of 1.7867 against the dollar. Stay short from 1.7754.

USD/CHF (1.2825)

Trend: Down

Current position: Neutral

It fell to as low as 1.2742 earlier. Look set to buy if resistance level of 1.2835 is breached.

USD/JPY (115.87)

Trend: Up

Current position: Neutral

The yen rose against the dollar after a government report showed Japan's trade surplus shrank less than expected in September. Stay neutral for now.

AUS/USD (0.7531)

Trend: Up

Current position: Short

Stay short from 0.7530.

USD/CAD (1.1716)

Trend: Down

Current position: Neutral

The loonie consolidated further on economy and interest rates outlook. Stay neutral for now.

Trend: Up

Current position: Neutral

Euro eases from two-week highs of 1.2139 against dollar. Look to sell if support fails to hold at 1.2044.

GBP/USD (1.7743)

Trend: Up

Current position: Short

Sterling retreated from a one-month high of 1.7867 against the dollar. Stay short from 1.7754.

USD/CHF (1.2825)

Trend: Down

Current position: Neutral

It fell to as low as 1.2742 earlier. Look set to buy if resistance level of 1.2835 is breached.

USD/JPY (115.87)

Trend: Up

Current position: Neutral

The yen rose against the dollar after a government report showed Japan's trade surplus shrank less than expected in September. Stay neutral for now.

AUS/USD (0.7531)

Trend: Up

Current position: Short

Stay short from 0.7530.

USD/CAD (1.1716)

Trend: Down

Current position: Neutral

The loonie consolidated further on economy and interest rates outlook. Stay neutral for now.

Thursday, October 20, 2005

Trend Check-up

Some new trends have emerged over the last 48 hours while I was away:

EUR/USD up support: 1.1958

GBP/USD up support: 1.7570

USD/CHF down resistance: 1.2988

USD/JPY down resistance: 115.70

USD/CAD down resistance: 1.1772

At the moment of posting, GBP/USD has already stretched further than the rest due to the stronger-than-expected retail sales data. I will be looking to execute a few more trades before the week ends.

EUR/USD up support: 1.1958

GBP/USD up support: 1.7570

USD/CHF down resistance: 1.2988

USD/JPY down resistance: 115.70

USD/CAD down resistance: 1.1772

At the moment of posting, GBP/USD has already stretched further than the rest due to the stronger-than-expected retail sales data. I will be looking to execute a few more trades before the week ends.

Tuesday, October 18, 2005

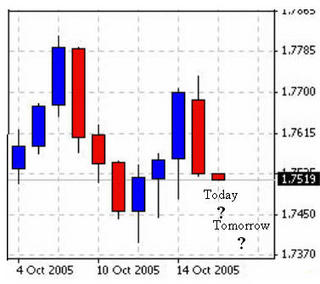

What Comes Next?

Friday, October 14, 2005

My Timing Trades

Finally, a nice end to the week.

The official trades at gfsignal and collective2 for this week are as follows:

Buy usd/cad at 1.1737 close at 1.1829

Buy gbp/usd at 1.7557 close at 1.7680

Buy eur/usd at 1.2025 close at 1.2094

What a relief after a week of hard work. I've been fine tuning my strategy and now I am able to spot the opportunities more easily and have become more flexible on the timing for entering and exiting trades. My daily swing strategy is still based on the daily D1 chart, but trades are now entered using H4, H1 and M30 charts.

The official trades at gfsignal and collective2 for this week are as follows:

Buy usd/cad at 1.1737 close at 1.1829

Buy gbp/usd at 1.7557 close at 1.7680

Buy eur/usd at 1.2025 close at 1.2094

What a relief after a week of hard work. I've been fine tuning my strategy and now I am able to spot the opportunities more easily and have become more flexible on the timing for entering and exiting trades. My daily swing strategy is still based on the daily D1 chart, but trades are now entered using H4, H1 and M30 charts.

Thursday, October 13, 2005

Setting Up USD/CAD (2)

Here is a hourly chart of USD/CAD for the last 48 hours . I've been trying to improve my timing on entering and exiting a particular market, after identifying pre-trend indications.

Here is a hourly chart of USD/CAD for the last 48 hours . I've been trying to improve my timing on entering and exiting a particular market, after identifying pre-trend indications.It seems that it could be a good practice to wait for a pull back in price/ momentum rather than entering the market straightaway.

Wednesday, October 12, 2005

Trade of the Day: Euro

H1 Chart

H1 Chart

Current Price: 1.1980

(Below D1 support of 1.2005)

Trend Check: D1 Up; H4 Down; H1 Down; M30 Down

A potential LONG positon: Enter position only when seeing trend reversal at least on both M30 and H1 charts.

Updated(1) 0915 GMT: Entered at 1.1980. We have got confirmation on both M30 and H1 charts about 15 mins ago, stay long with stop loss at 1.1960, intial target of 1.2050.

Updated(2) 1345 GMT: Exit at 1.2030. Although didn't quite hit the target of 1.2050, I will be happy to close this position for a 50 pips profit for now. I will continue to monitor and buy at the next dip.

Updated(1) 0915 GMT: Entered at 1.1980. We have got confirmation on both M30 and H1 charts about 15 mins ago, stay long with stop loss at 1.1960, intial target of 1.2050.

Updated(2) 1345 GMT: Exit at 1.2030. Although didn't quite hit the target of 1.2050, I will be happy to close this position for a 50 pips profit for now. I will continue to monitor and buy at the next dip.

Tuesday, October 11, 2005

Watching Over Pound

Setting Up USD/CAD

I realised that I need to have more patience in setting up my forex swing trades. For the past couple of days, I have been watching individual price movements on H4, H1 and even M30 charts.

My aim is to try finding a correlation between these charts with the daily chart trend pattern I used and thus determining the best price for entering and exiting a particular market.

My past strategy has so far restricted me to take a larger profit or even sometimes straight into a losing position only minutes after opening a position. Therefore, I should be more scrutinous as the market always seems to trick you to take the opposite direction.

Currently, I like the outlook of USD/CAD where all charts, i.e D1, H4, H1 and M30 charts all flagging a long signal, which I will not hesitate to take at this time. I will put up an analysis in a later post.

My aim is to try finding a correlation between these charts with the daily chart trend pattern I used and thus determining the best price for entering and exiting a particular market.

My past strategy has so far restricted me to take a larger profit or even sometimes straight into a losing position only minutes after opening a position. Therefore, I should be more scrutinous as the market always seems to trick you to take the opposite direction.

Currently, I like the outlook of USD/CAD where all charts, i.e D1, H4, H1 and M30 charts all flagging a long signal, which I will not hesitate to take at this time. I will put up an analysis in a later post.

Wednesday, October 5, 2005

Finding the Bottleneck

September was a difficult and testing month for my swing strategy as I could finally determine where the system's bottlenecks are going to be. As my system is not fully mechanical yet, I have to constantly study charts, understand the fundamentals and technicals and do a lot of analytical work by hand. It is always exciting when you know there is still room for improvement in the system.

One thing I realised is that it is usually best to leave the system uninterrupted no matter the drawdown because I was usually wrong most of the time after I have intervened to take profits or stop a loss.

And, it is also about time for a change in the signal trading hours to better implement the swing approach. Hope it all works out and better results in months ahead.

One thing I realised is that it is usually best to leave the system uninterrupted no matter the drawdown because I was usually wrong most of the time after I have intervened to take profits or stop a loss.

And, it is also about time for a change in the signal trading hours to better implement the swing approach. Hope it all works out and better results in months ahead.

Subscribe to:

Posts (Atom)